Short term Q1 2024 to Q4 2024

TEXT DESCRIPTION

Presentation

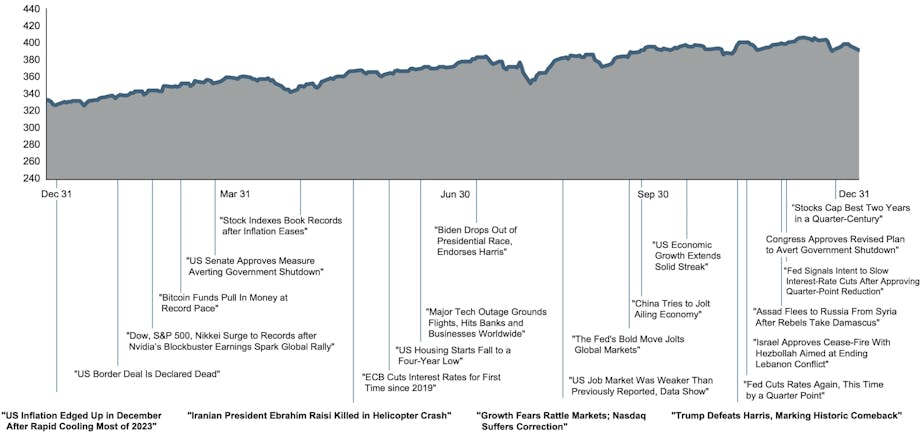

Line chart with MSCI All Country World Index along the Y-axis with a range of 240 to 440, and quarters along the X-axis ranging from Dec 31, 2023 to Dec 31, 2024. The chart shows the index increasing about 60 points over the time period and is annotated with newspaper headlines which are described under the Data section.

Data

Q1 2024

- US Inflation Edged Up in December After Rapid Cooling Most of 2023

- US Border Deal Is Declared Dead

- Dow, S&P 500, Nikkei Surge to Records After Nvidia's Blockbuster Earnings Spark Global Rally

- Bitcoin Funds Pull In Money at Record Pace

- US Senate Approves Measure Averting Government Shutdown

Q2 2024

- Stock Indexes Book Records After Inflation Eases

- Iranian President Ebrahim Raisi Killed in Helicopter Crash

- ECB Cuts Interest Rates for First Time Since 2019

- US Housing Starts Fall to a Four-Year Low

- Major Tech Outage Grounds Flights, Hits Banks and Businesses Worldwide

Q3 2024

- Biden Drops Out of Presidential Race, Endorses Harris

- Growth Fears Rattle Markets; Nasdaq Suffers Correction

- US Job Market Was Weaker Than Previously Reported, Data Show

- The Fed's Bold Move Jolts Global Markets

- China Tries to Jolt Ailing Economy

Q4 2024

- US Economic Growth Extends Solid Streak

- Trump Defeats Harris, Marking Historic Comeback

- Fed Cuts Rates Again, This Time by a Quarter Point

- Israel Approves Cease-Fire With Hezbollah Aimed at Ending Lebanon Conflict

- Assad Flees to Russia From Syria After Rebels Take Damascus

- Congress Approves Revised Plan to Avert Government Shutdown

- Fed Signals Intent to Slow Interest-Rate Cuts After Approving Quarter-Point Reduction

- Stocks Cap Best Two Years in a Quarter-Century

Accessibility Statement

This website is run by R|W Investment Management. We strive to make our website as accessible as possible. If you would like to receive this content in a different way, please contact us toll-free at (844) 834-7500.