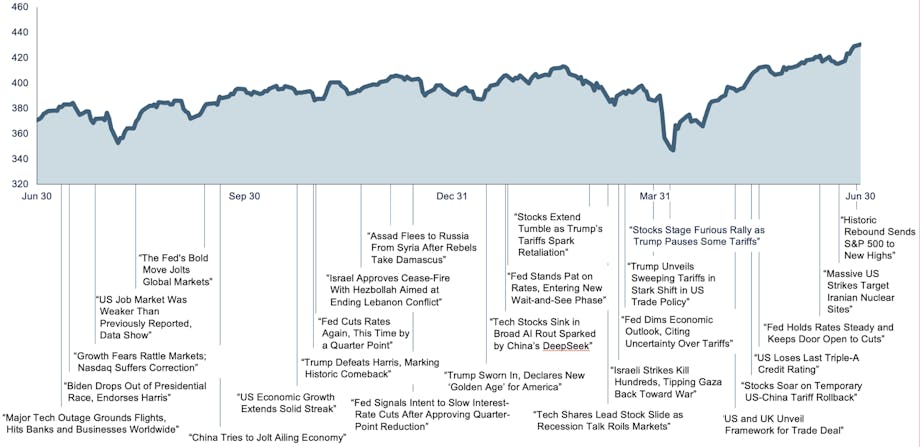

Short term MSCI All Country World Index with selected headlines from Q2 2025

TEXT DESCRIPTION

Presentation

Line chart showing U.S. stock market performance during Q2 2025, with major geopolitical and economic news events annotated along the timeline, including tariff changes, interest rate moves, inflation data, and geopolitical tensions.

Data

June 30, 2024

- Major Tech Outage Grounds Flights, Hits Banks and Businesses Worldwide

- Biden Drops Out of Presidential Race, Endorses Harris

- Growth Fears Rattle Markets; Nasdaq Suffers Correction

- US Job Market Was Weaker Than Previously Reported, Data Show

- The Fed's Bold Move Jolts Global Markets

- China Tries to Jolt Ailing Economy

September 30, 2024

- US Economic Growth Extends Solid Streak

- Trump Defeats Harris, Marking Historic Comeback

- Fed Cuts Rates Again, This Time by a Quarter Point

- Israel Approves Cease-Fire With Hezbollah Aimed at Ending Lebanon Conflict

- Assad Flees to Russia From Syria After Rebels Take Damascus

- Fed Signals Intent to Slow Interest-Rate Cuts After Approving Quarter-Point Reduction

December 31, 2024

- Trump Sworn In, Declares New 'Golden Age' for America

- Tech Stocks Sink in Broad AI Rout Sparked by China’s DeepSeek

- Fed Stands Pat on Rates, Entering New Wait-and-See Phase

- Stocks Extend Tumble as Trump’s Tariffs Spark Retaliation

- Tech Shares Lead Stock Slide as Recession Talk Roils Markets

- Israeli Strikes Kill Hundreds, Tipping Gaza Back Toward War

- Fed Dims Economic Outlook, Citing Uncertainty Over Tariffs

March 31, 2025

- Trump Unveils Sweeping Tariffs in Stark Shift in US Trade Policy

- Stocks Stage Furious Rally as Trump Pauses Some Tariffs

- US and UK Unveil Framework for Trade Deal

- Stocks Soar on Temporary US-China Tariff Rollback

- US Loses Last Triple-A Credit Rating

- Fed Holds Rates Steady and Keeps Door Open to Cuts

- Massive US Strikes Target Iranian Nuclear Sites

- Historic Rebound Sends S&P 500 to New Highs

Accessibility Statement

This website is run by R|W Investment Management. We strive to make our website as accessible as possible. If you would like to receive this content in a different way, please contact us toll-free at (844) 834-7500.